If you’ve been relying on API-based providers for staking data, you’ve likely run into the same issues: downtime, missing rewards, and lagging updates. That’s not just inconvenient – it breaks reconciliations, disrupts audits, and forces your team to waste hours patching holes.

We built TRES to eliminate those problems entirely.

The Problem With API-Based Staking Data

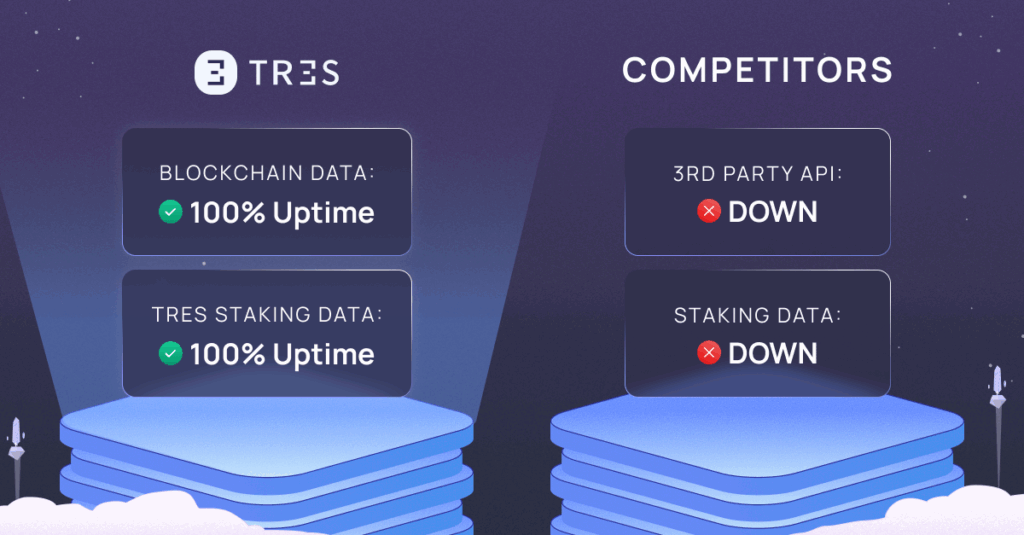

Most providers depend on third-party APIs to deliver staking rewards. That dependency creates structural weaknesses that no amount of support tickets can fix:

- Downtime: When their upstream API goes down, your reports go dark.

- Lagging data: Rewards are often hours behind the blockchain.

- Gaps in coverage: Accrued rewards and protocol-specific edge cases get missed.

- Black-box calculations: You can’t fully audit how numbers are derived.

For a finance or compliance team, this isn’t just frustrating. It makes your books unreliable. And when auditors start asking questions, “our API was down” is not an acceptable answer.

How TRES Solves It

At TRES, we designed our staking data pipeline to avoid those structural flaws. Instead of leaning on others’ APIs, we pull staking reward data directly from the blockchain.

Here’s what that means in practice:

- Direct on-chain queries: We capture validator activity, delegator states, vaults, and transactions straight from the source.

- Both claimed and accrued rewards: We account for what’s already distributed and what’s pending – essential for accurate period-end reporting.

- 200+ networks supported: Our clients don’t have to juggle multiple providers or accept partial coverage.

- Unified data model: All protocols and chains feed into a single standardized format, so finance teams can work with one consistent set of numbers.

As long as the chain itself is live, your staking data in TRES is live too. There’s no third-party API in the middle that can fail you.

Why Finance Teams Are Switching

We hear the same story again and again from teams that left our competitors:

- “Our reports were missing days of staking data.”

- “APIs went down right before quarter-end close.”

- “We wasted hours manually filling the gaps.”

When those teams switch to TRES, the difference is immediate:

- Audit-ready accuracy — complete records of both accrued and claimed rewards.

- Zero API-related downtime — no more waiting on someone else’s infrastructure.

- Faster closes — reconciliations that used to drag now run without interruptions.

- Full transparency — clear lineage from the blockchain to your books.

That reliability doesn’t just save headaches — it protects compliance, investor trust, and the bottom line.

Why “Good Enough” Isn’t Good Enough

It’s easy to think a little downtime or lag is just the cost of doing business with staking data. But for companies with material exposure to staking rewards, “good enough” is dangerous. Small gaps add up quickly, and the cost of explaining missing rewards to auditors or regulators far outweighs the convenience of sticking with a fragile API-based provider.

With TRES, you don’t have to settle for “good enough.” You get financial-grade staking data you can trust, every time.

Ready to Leave Downtime Behind?

If you’re dealing with outages or stale staking data, you don’t have to keep working around the gaps. TRES is built from the ground up to deliver uninterrupted, accurate staking data across 200+ networks.

Talk to us today about switching to TRES.

When your business depends on accurate staking rewards, downtime isn’t an option.

Interested in TRES?