Digital asset tax reporting in the U.S. is about to change dramatically.

The introduction of Form 1099-DA is just the beginning – platforms will face stricter IRS obligations and significantly higher reporting complexity.

TRES now makes it simple.

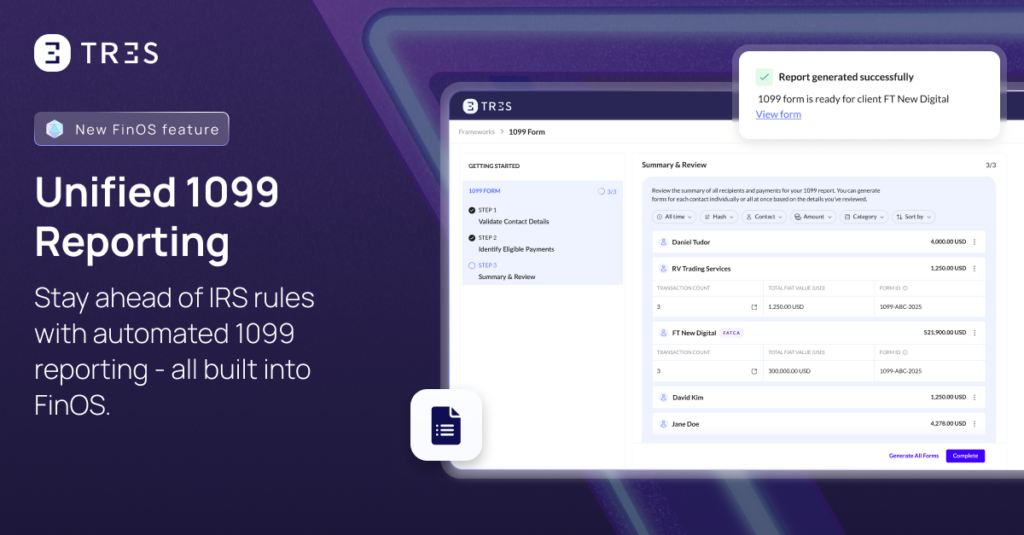

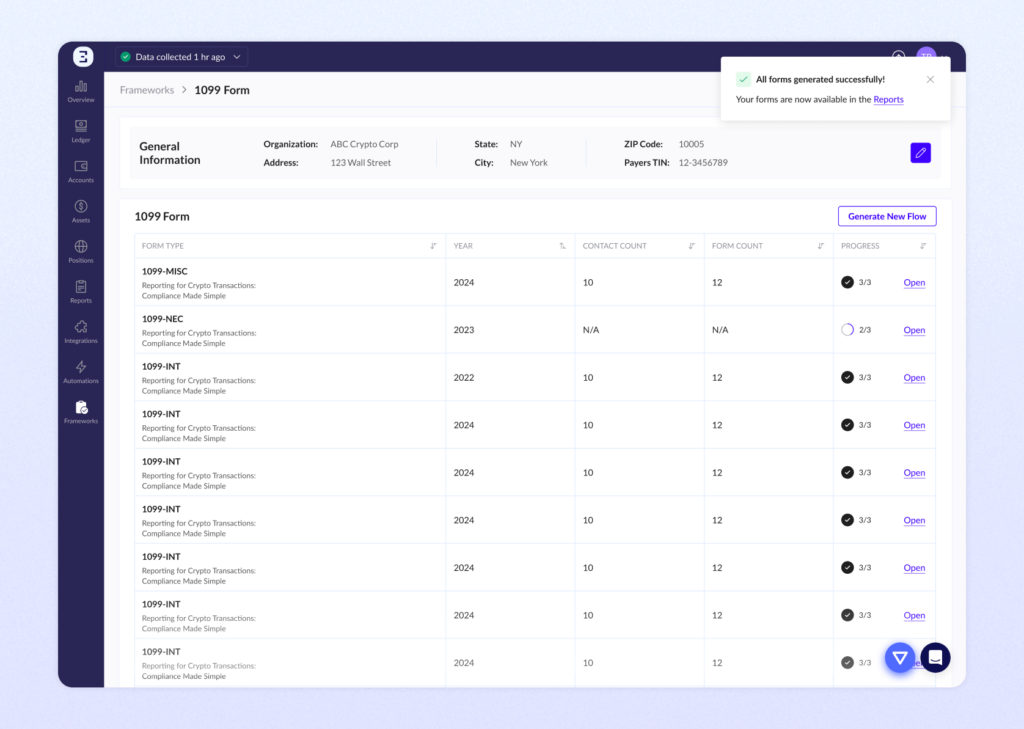

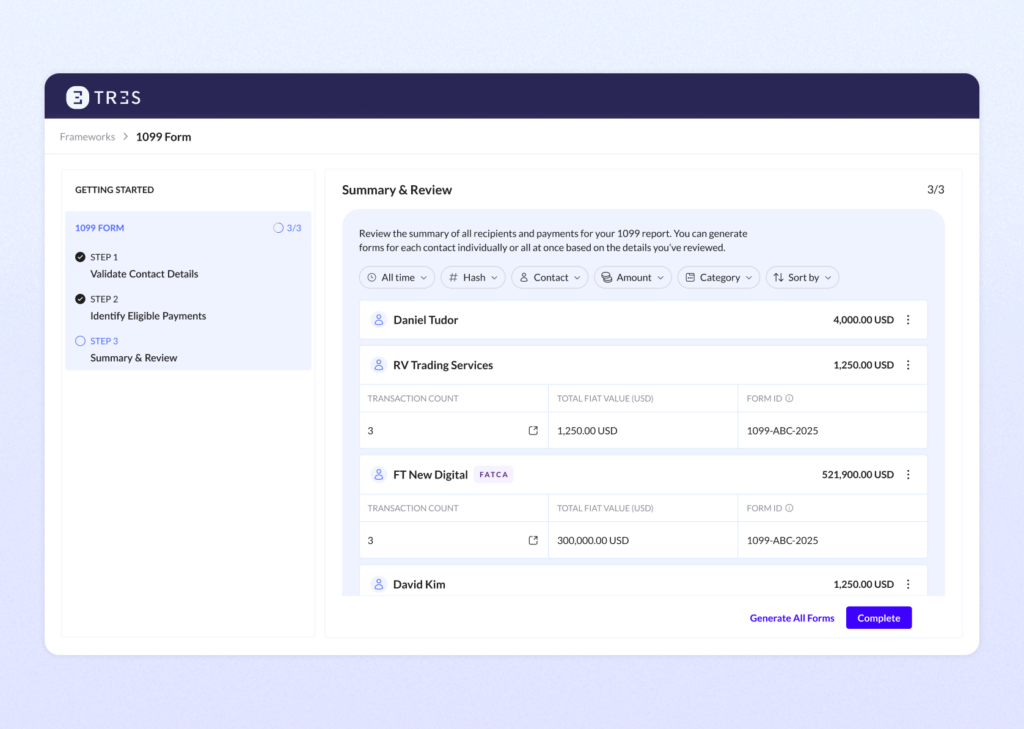

Our latest FinOS feature brings full support for 1099-B, 1099-MISC and 1099-NEC into one platform, with early support for 1099-DA now in beta, helping you automate, comply, and stay ahead of regulation without the manual burden.

The Challenge is real. The solution is TRES FinOS.

The upcoming IRS reporting rules for digital assets, primarily under the Infrastructure Investment and Jobs Act (IIJA), alongside existing 1099 requirements, place significant new obligations on businesses in this space. Exchanges, custodians, staking providers, payment platforms are responsible for:

- Tracking every single client transaction: Every financial movement – deposits, sales, swaps, staking rewards, DeFi yields, payments, withdrawals, non-employee compensation. We got you covered.

- Accurately calculating cost basis: A notoriously complex task across all asset types, especially vital for Form 1099-DA and 1099-B, involving various accounting methods (FIFO, Specific ID) and assets transferred between platforms.

- Determining fair market value (FMV): Crucial for income events (1099-MISC), crypto-to-crypto trades (1099-DA), and valuing non-cash payments.

- Generating thousands, even millions, of accurate tax forms: Efficiently, consistently, and on time for both your customers and the IRS – across the entire 1099 suite.

These aren’t just operational hurdles; they represent significant compliance risks if not managed with a unified, specialized approach.

TRES: One platform for end-to-end 1099 compliance

FinOS now automates the full 1099 lifecycle – from data collection to form generation – for 1099-B, 1099-MISC and 1099-NEC.

Here’s how TRES delivers:

Unified 1099-B, MISC, NEC & 1099-DA support: TRES automated 1099 forms on a single platform.

Full automation, minimal manual work: From data gathering, to sophisticated cost basis tracking and final form output, TRES reduces manual input, lowering error rates and saving internal resources.

Native cost basis engine: Automatically calculate cost basis using IRS-approved methods like FIFO and Specific ID. FinOS supports complex asset histories, including staking rewards, airdrops, and wallet transfers – all with audit-ready accuracy.

Granular cost basis control: Make precise adjustments with full flexibility – edit individual transactions directly in the UI, apply bulk updates for high-volume changes, or integrate programmatic adjustments via API. Maintain a full audit trail for every change.

Best-in-class staking reward reporting: Generate precise 1099-MISC forms using rewards data across 120+ blockchain networks. Income is reported accurately at the moment of receipt – no approximations.

Web app or API integration. Use the FinOS dashboard for hands-on control, or plug into your existing exchange databases, wallet ledgers, and accounting software with our robust API suite.

Audit-ready & future-proof: Stay ahead of regulation with infrastructure designed for evolving IRS rules. Every process is backed by detailed audit trails and enterprise-grade compliance standards.

With TRES, you can:

- Reduce regulatory risk: Minimize manual errors and penalties associated with incorrect or late filings.

- Save time and resources: Automate workflows and free up time to focus on your core business.

- Improve the customer experience: Provide accurate and timely tax reporting to your users.

- Operate with Confidence: Know your digital asset tax reporting is handled by experts and built for compliance at scale.

The time to act is now.

To meet IRS requirements taking effect in 2026, platforms must already be capturing transaction-level data across 2025.

The window to get compliant is closing fast. Putting the right infrastructure in place now means no last-minute scrambles, fewer risks, and a smoother tax season for both your team and your customers.

Don’t just prepare for the new rules – stay ahead with TRES.

Want to see this feature in action? Book a demo

Interested in TRES?