Negative balances (also called volume error or negative inventory) are crypto accounting’s silent sabotage. It blocks basic steps such as cost basis calculation and book closing, then ripples into ERP sync failures.

The Domino Effect

- Cost basis cannot be calculated, so tax deadlines slip.

- Books stay open because balances will not reconcile.

- ERP integrations reject the feed. Finance teams end up exporting CSVs and hand-keying data.

Why Does It Happen?

| Category | Root Cause | Example |

| Compound balances | Rewards compound without explicit transactions | Balances of Aave lending tokens, stETH, or yield-bearing stablecoins like aUSDC increase without a corresponding inflow on-chain, making historical reconciliation difficult |

| Mismarked non-taxable | Only one leg of a staking or bridge transaction is flagged non-taxable | A staking reward is marked non-taxable, but the associated staking lockup isn’t, causing an inventory discrepancy |

| Missing transactions | Collectors fail to capture inflows from bridges, genesis funds, new protocols | Bridging ETH to a new L2 wallet or initializing a wallet with a genesis balance gets missed due to unsupported or unindexed protocol activity |

| API blind spots | Exchanges limit historical pulls | OKX’s API allows access to only the past three months of trade history, excluding older activity needed for reconciliation |

| Short or off-chain exposure | Shorts or collateralised loans create synthetic negatives | A BTC loan on B2C2 or a short position on Bybit introduces a negative BTC balance without an inflow transaction to offset it |

Manual Fixes Waste Hours

Most platforms still push users toward manual workarounds. Rather than preventing negative balance errors, they surface the symptoms and expect you to dig through the data to resolve them.

Take Bitwave’s own FAQ, for example. Their support page outlines a multi-step manual workflow that includes uncategorizing and re-categorizing specific transactions, checking ignored items, and applying rounding reversals by editing historical entries:

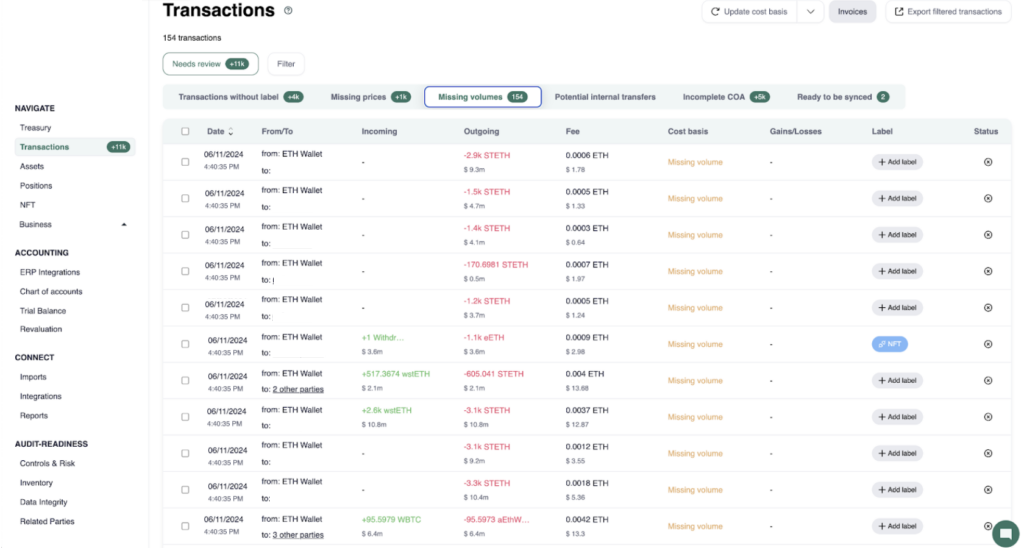

Cryptio follows a similar pattern. Its dashboard displays negative balance issues, tagging them as “Missing Volume.” But while it identifies problem areas, the platform leaves it to the user to understand and correct the underlying causes:

Stop Patching. Start Reconciling

TRES Finance compresses the entire workflow into a few clicks.

Missing transactions solved

TRES uses dedicated RPC nodes and proprietary indexers to capture all types of transactions — including genesis allocations, bridged funds, and new protocol interactions. As new protocols launch on mainnet, they’re indexed automatically. TRES is SOC 1 certified and continuously reconciles incoming data, giving you real-time visibility on gaps.

Compounding assets reconciled

TRES historical reconciliation tools allow you to inspect and fix balance drifts caused by implicit compounding rewards. You can pinpoint exactly where your stETH or aUSDC balance diverged from expected totals and apply adjustments contextually.

Non-taxable flags corrected

The TRES cost basis inventory report highlights transactions where non-taxable status is mismatched — such as a staking reward being marked non-taxable but not the lockup. This lets users quickly identify and bulk-correct classification errors without diving into each transaction manually.

API limits bypassed

If an exchange API won’t serve the data, TRES accepts historical ledgers via AI-powered CSV ingestion. Users are guided through a clean import flow and supported by TRES’s technical team when needed.

Short positions accounted for

TRES allows you to set and apply short-specific cost basis logic. This ensures that negative balance stemming from OTC loans or short positions is treated correctly and reconciles within your tax and reporting framework.

Users report a ninety percent drop in time spent chasing negative balances within the first month.

Interested in TRES?