TRES Finance provides a complete, automated workflow for generating ready-to-file 1099s – built for digital-asset reporting at scale. If you’re a U.S. business making reportable payments, including digital-asset payments, you have a 1099 filing obligation. And the deadline is approaching: recipient copies – and 1099-NEC to the IRS – are due February 2, 2026.

Why this matters

Regulatory expectations for crypto reporting keep rising. Finance teams need a clear audit trail, consistent classification, and documentation that holds up under IRS and auditor scrutiny.

TRES consolidates on chain activity across multiple sources, giving finance teams a single source of truth. Extending this into tax documentation allows clients to close a critical compliance gap without building internal processes or maintaining complex spreadsheets.

How TRES identifies 1099 relevant activity

Transactions such as staking rewards, incentive payouts, and similar reward based income typically fall under 1099 MISC reporting requirements. TRES identifies these transactions using the same enriched classification engine that powers the rest of the platform.

Instead of relying on manual tagging or ad hoc processes, teams receive a pre-filtered list of potentially relevant items that require only review and confirmation.

The 1099 workflow in TRES

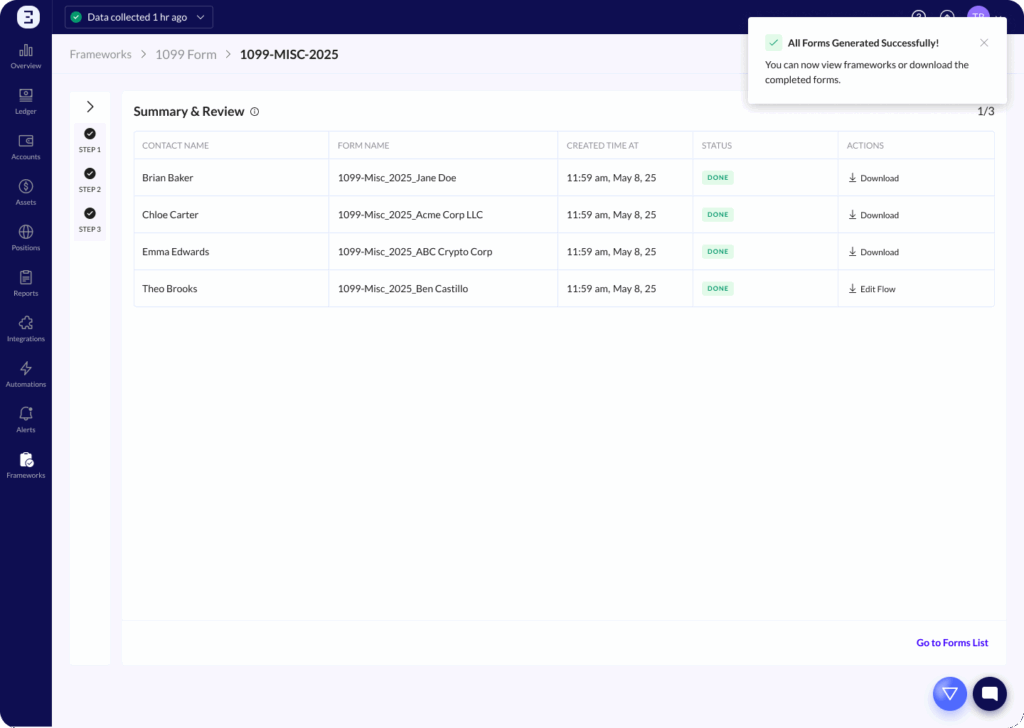

The flow is designed to be simple, controlled, and fully auditable:

- Select the tax year.

The platform scopes all on chain activity for the selected period. - Automatic detection of relevant transactions.

Reward based income, including staking rewards, is flagged for potential inclusion. - Review vendor information.

Users confirm or complete payee details. - Review the transaction list.

The platform shows all transactions that may be reportable. - Confirm classifications.

Users adjust or approve categorization as needed. - Approve the final set.

Users lock the final list before generation. - Generate output files. TRES produces both PDF and CSV versions of the 1099 forms, ready for submission to the IRS, or any approved filing partner.

Looking ahead: support for 1099 DA

The forthcoming 1099 DA, expected to apply beginning next year, will introduce new reporting requirements for digital asset dispositions. TRES will support this form once it becomes applicable, allowing clients to stay aligned with regulatory expectations while maintaining the same workflow they already use.

Get started

The 1099 reporting workflow is available today for all TRES clients.

Contact your dedicated account manager, or if you’re new to TRES, book a demo to see how FinOS gets you 1099-ready before the deadline.

Interested in TRES?