The rules are changing faster than ever.

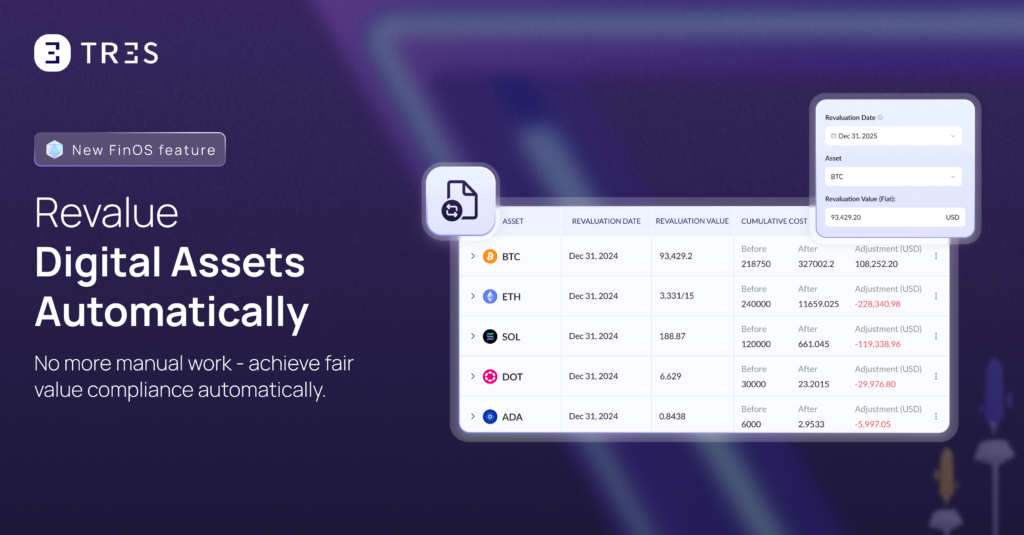

In just the past three months, U.S. regulators have introduced sweeping updates: FASB’s fair value accounting standards, IRS wallet-level mandates, and the 1099-DA reporting rule. Add global changes like MiCA and CASP in Europe, and staying compliant is becoming a full-time job. That’s why TRES is introducing our latest feature: Cost Basis Revaluation. Built to keep finance teams compliant and audit-ready as accounting standards evolve at a rapid pace. No more manual lookups, no more spreadsheet gymnastics, just simple, automated revaluations aligned with GAAP, IFRS, and global best practices.

Fair Market Value per Accounting Standard

Cost Basis Revaluation is traditionally how businesses reassess the value of their crypto holdings under certain accounting frameworks, aiming for accurate reporting and compliance. Recent developments by the Financial Accounting Standards Board (FASB) signal a shift toward fair value reporting for digital assets, meaning the traditional “impairment-only” model under U.S. GAAP has ended.

GAAP (Legacy vs. New Practice)

In December 2023, the FASB issued a new rule, ASU 2023-08, requiring certain crypto assets to be measured at fair value at the end of each reporting period. This standard becomes effective for fiscal years beginning after December 15, 2024 (practically, 2025). The revaluation must be performed using Principal Market pricing per asset as defined in IFRS 13.

This change ends the impairment testing model, where crypto assets were classified as indefinite-lived intangible assets. Under the legacy approach, if the market value fell below the carrying amount, an impairment loss had to be recorded using the lowest observable market price. Any recovery in value could not be reflected until the asset was sold.

IFRS

Companies can choose between the cost model (with impairment testing) and the revaluation model for measuring crypto assets. Under the cost model, impairment testing must occur if there are indicators of value decline, and upward revaluations are not allowed unless the asset is sold.However, if an active market exists, companies may elect the revaluation model, which allows both upward and downward revaluations to reflect fair value. In such cases, ongoing revaluations are required, with changes in value recorded in Other Comprehensive Income (OCI) or profit and loss, depending on the asset’s classification.

Cost Basis Revaluation in Practice

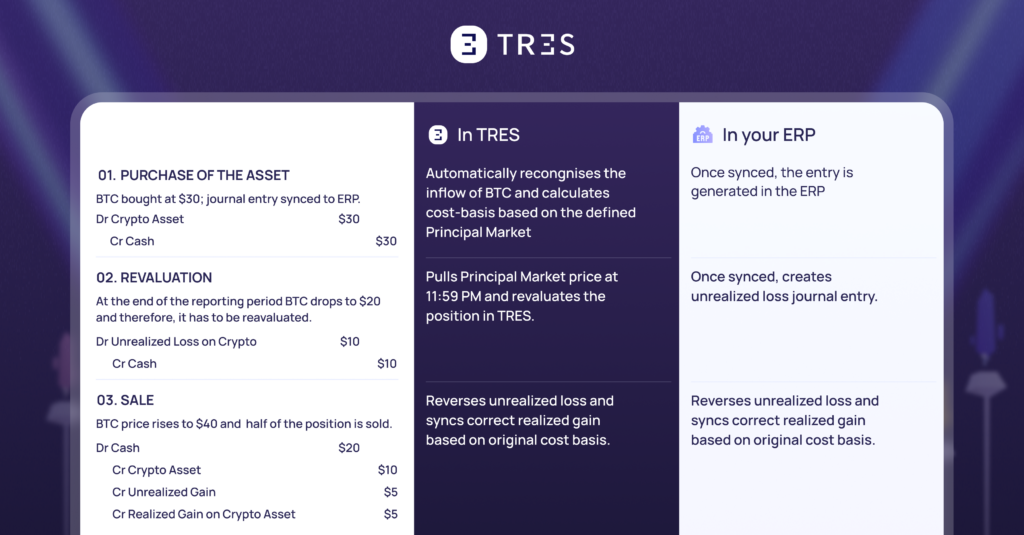

The following outlines the steps finance teams must follow and how TRES simplifies the process:

- Revalue the inventory of all crypto assets to fair market value at the end of each reporting period, using the principal market pricing at the close of business (11:59 PM).

How does TRES help? Users select a date and asset, and TRES pulls the Principal Market price as of 11:59 PM. No manual entry required. - Recognize unrealized gains or losses in the income statement (P&L).

How does TRES help? After revaluation, users can sync the ledger to their ERP, automatically generating one entry per asset to reflect the difference between cost basis and fair value. - Disclose the cost basis, fair value, and period changes in financial reports.

How does TRES help? TRES provides a dashboard with all revaluation details for export and audit support. - Maintain a consistent valuation method and enforce internal controls around valuation inputs.

How does TRES help? Clients can reference their chosen pricing feed per asset to comply with Principal Market requirements.

What if…?

The asset is sold after the revaluation?

When an organization sells an asset that has been revalued, realized gains must account for all previously recorded unrealized gains or losses. TRES automatically adjusts the realized gain calculation by incorporating the full history of revaluations, ensuring accuracy in financial reporting.

My company needs to prepare capital gains using realized gains?

Revaluing an asset at period-end does not qualify as a sale and does not trigger capital gains tax. TRES continues to track the original cost basis (excluding revaluation effects) to ensure proper tax reporting when an actual sale occurs.

Simplified Compliance, Streamlined Audits

At TRES, we empower businesses worldwide to maintain compliance with ease. With unparalleled data accuracy and a streamlined FinOps experience, we make every step of the accounting journey effortless.

Book a demo with the TRES team today and experience how we can help make financial compliance simple for your business.

Interested in TRES?