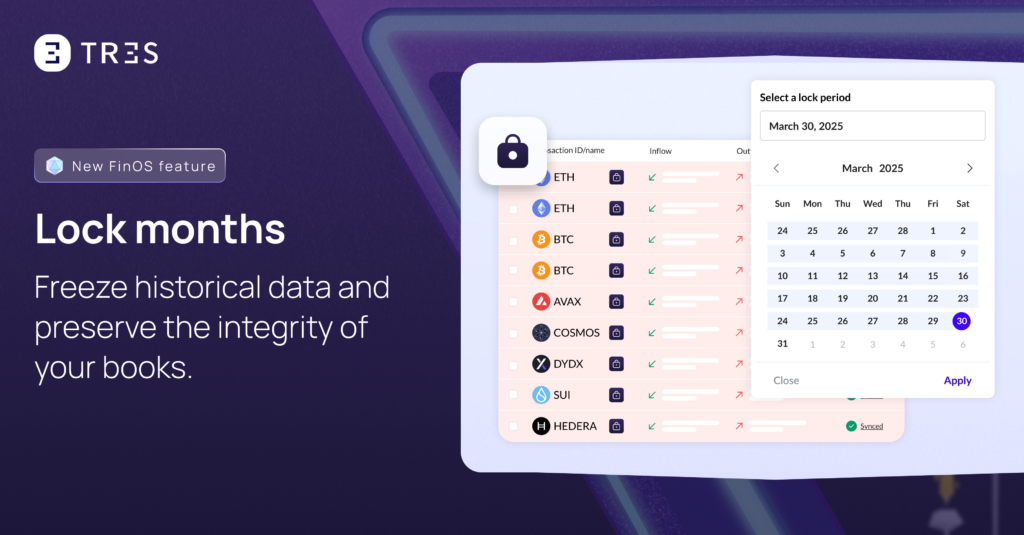

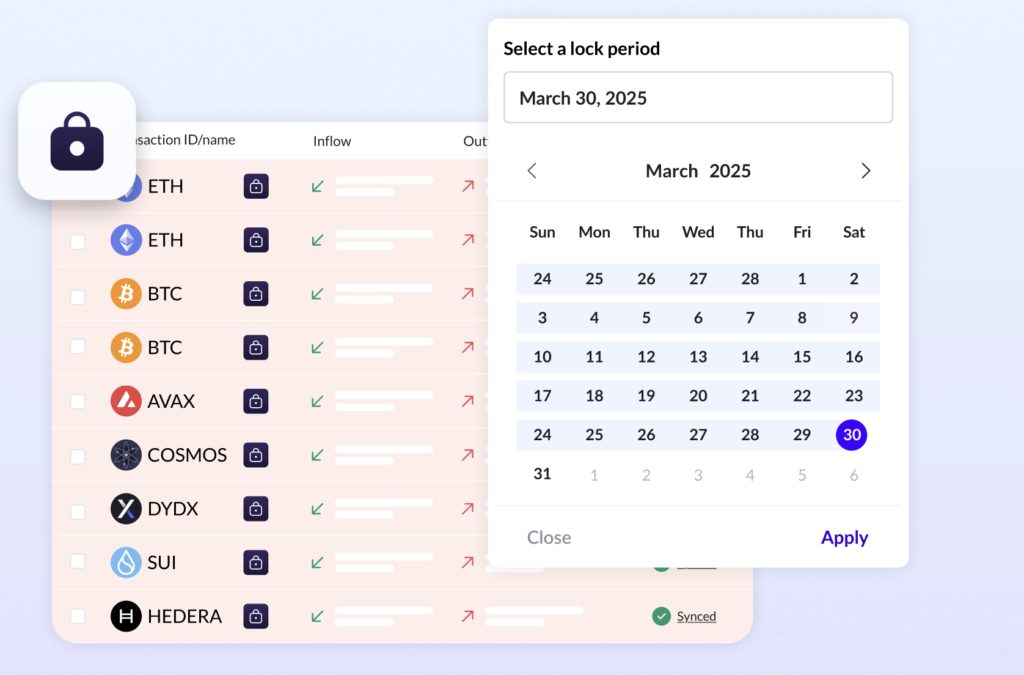

In crypto accounting, accuracy is non-negotiable. Once a period has been reviewed and finalized, the last thing your finance team needs is an accidental backdated adjustment or a label change that throws off your cost basis. That’s why we’ve introduced Lock Months, a new FinOS feature that lets you freeze historical data to prevent unintended changes and preserve the integrity of your books.

Why Locking Matters

Locking is a critical internal control, especially when managing complex crypto transactions across wallets, chains, and entities. Without it, finalized reports risk being compromised by late data entries, editing mistakes, new wallets added to the organization or changes to your account configuration.

With Lock Months, TRES customers can now:

- Prevent edits to previously booked cost basis.

- Lock in transaction labels on finalized entries.

- Freeze asset values to avoid retroactive changes to financial statements.

Whether you are aligning with your ERP system, preparing for an audit, or closing the books with confidence, Lock Months gives you the control to lock in accuracy and avoid inconsistencies.

What Gets Locked

Once Lock Months is enabled for a specific period, all data up to that date becomes fixed and protected from changes. The locking date is defined in the organization settings and represents the moment books are considered closed. From that point forward, FinOS will automatically prevent any updates that could affect the integrity of finalized records.

The Following Elements Are Impacted:

- Cost Basis and Principal Market: Locked transactions will retain their original cost basis and pricing source. No recalculations or overrides are allowed before the locked date.

- Exchange Rates (Fiat Values): Fiat valuations are preserved. Editing fiat rates or recalculating values on locked entries is blocked.

- Labels and Classifications: Taxable and non-taxable labels (e.g., internal transfers) can’t be applied or modified. Classification rules are bypassed for locked transactions.

- Wallet Management

Adding: New wallets can be added at any time. If the wallet includes transactions dated before the locked period, those entries will be bypassed. They won’t be synced, classified, evaluated, or included in cost basis calculations. This ensures that locked books remain unchanged even as new data is introduced. - Eliminating: Wallets containing transactions within the locked period cannot be removed through the interface. Any deletion or cleanup action affecting locked data must be handled manually by customer support to preserve data consistency and audit integrity.

- Transaction Editing: You cannot add or delete transactions that fall before the locked date.

- Manual transaction creation or CSV uploads for locked periods will be rejected.

- Transaction reconciliation and re-evaluation only occur on entries after the locked period.

- Internal transfers, groupings, and SPAM markings are restricted for locked entries.

- ERP and Syncing: Running full ERP sync on locked periods is disabeled.

- Locked transactions are excluded from sync suggestions and updates.

- Cost basis method changes will only apply to new transactions after the locked date.

Benefits for Your Finance Team

With Lock Months, your team can:

- Prevent unintended changes that compromise data accuracy.

- Ensure consistent and compliant reporting aligned with ERP and audit workflows.

- Reduce reconciliation complexity by freezing cost basis and valuations at the time of booking.

- Prepare for audits with confidence, knowing that prior periods are preserved exactly as finalized

How It Works

From your FinOS dashboard, navigate to the workspace settings and choose the period you want to lock. With just one click, you can toggle Lock Month to secure all transactions up to that date.

Freeze Historical Data to Preserve the Integrity of Your Books

Lock Months is built to support crypto finance teams with the same rigor and reliability they expect from their ERP systems. Whether you’re closing monthly reports or preparing for year-end audits, Lock Months helps ensure your financials remain fixed, reliable, and compliant.

Interested in TRES?