In volatile crypto markets, the cost basis methodology you choose directly influences your realized gains and tax exposure. Traditional methods like FIFO, LIFO, or HIFO apply rigid rules that limit strategic flexibility. SPEC ID takes a more adaptive approach by allowing you to match each transaction to any historical lot, giving finance teams the ability to optimize tax outcomes with precision.

TRES’s SPEC ID gives you full control to match sales with historical lots while ensuring compliance by eliminating gaps in cost basis reporting.

What is SPEC ID?

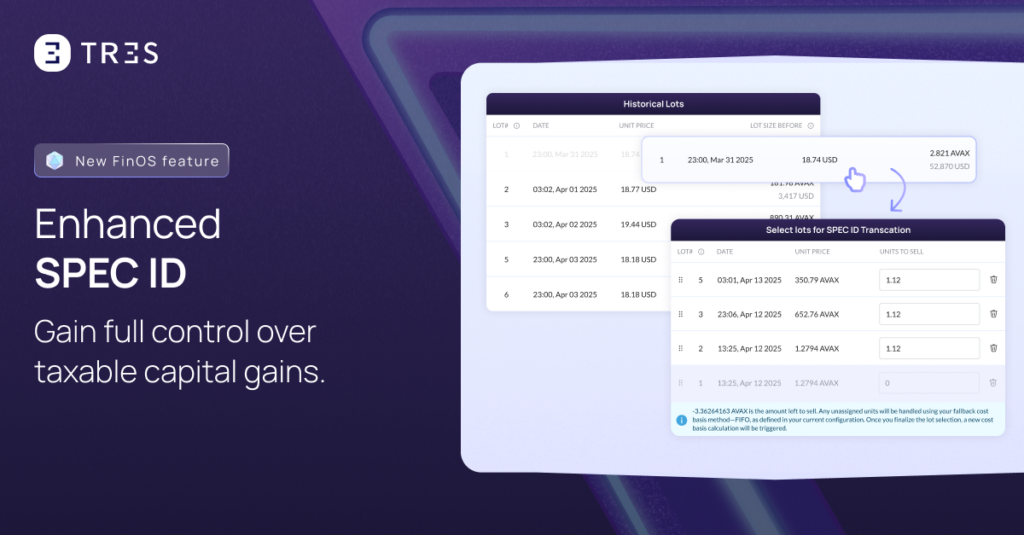

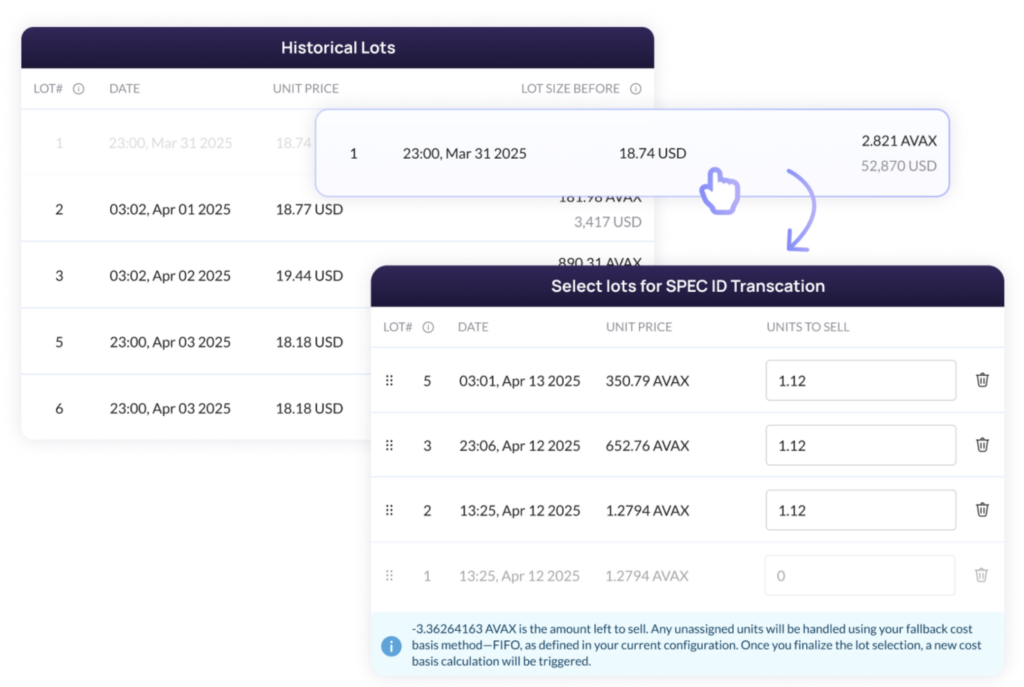

SPEC ID (Specific Identification) lets you match any crypto sale to specific, previously acquired lots – giving you transaction-level control.

This method is accepted under U.S. tax regulations and is commonly used to:

- Minimize realized gains.

- Harvest losses to reduce taxable income.

- Optimize capital gains timing before performance-based NAV fees are calculated.

Gain transaction-level precision without compromising compliance

SPEC ID is primarily used by asset managers and their fund administrators to optimize how taxable gains are realized throughout the year – especially during redemption periods and year-end tax planning, when harvesting losses becomes a priority.

While these strategies create real financial advantages, they are traditionally manual, error-prone, and difficult to audit. Every lot-matching decision must be tracked perfectly to ensure compliance.

At TRES, we’ve built a seamless experience that enables asset managers to apply SPEC ID confidently, at scale, and without friction. We crafted a solution with following benefits:

- Audit-ready transparency, with a dedicated dashboard that logs a full history of SPEC ID applications across all transactions.

- No gaps in cost basis by using a fallback method like FIFO, LIFO, or HIFO when SPEC ID is not applied.

- Validate realized gains and losses before syncing to your ERP, so you can understand the impact before it becomes real in your books.

- Maximum flexibility, allowing users to match each transaction to one or more historical lots associated with the selected asset.

How SPEC ID Works at TRES

At TRES, we’ve built SPEC ID to be intuitive, auditable, and deeply integrated into your existing financial workflows.

Here’s how it works in practice:

- Set fallback logic to ensure continuity

If SPEC ID is not applied to a transaction, your default method (FIFO, LIFO, HIFO, or Weighted Average) is automatically used to ensure there are no data gaps. - Select transactions directly from the Ledger or via API

Choose which sales should use SPEC ID instead of your default cost basis method. You can apply this selectively to any transaction that would benefit from lot-level control. - Match to one or more historical lots

Once selected, you can match the transaction to any historical lot associated with the asset. TRES provides full visibility into available lots, including acquisition date and cost. - Validate realized gains and losses before syncing

Use the dashboard or reporting module to review calculated gains and losses for SPEC ID transactions before syncing to your ERP or generating NAV reports. - Maintain full audit history

Every SPEC ID rule, fallback, and lot selection is stored and visible — ensuring audit readiness and simplifying collaboration with fund admins, auditors, and tax teams.

Take Control of Your Realized Gains

SPEC ID transforms a traditionally manual, high-risk tax process into a controlled, strategic advantage. With TRES, you can apply specific identification where it matters most, automate lot matching, and maintain a complete audit trail without slowing down operations.

Experience how TRES helps you reduce tax exposure, stay compliant, and bring precision to every realized gain. Book a demo today.

Interested in TRES?