At TRES we work every day to simplify every step of your web3 accounting journey.

With the introduction of our new Cost Basis Revaluation feature, we’re taking another significant step forward—streamlining your accounting processes while ensuring compliance with global standards such as GAAP and IFRS.

Cost-Basis Revaluation in Practice

Cost Basis Revaluation is traditionally how businesses reassess the value of their crypto holdings under certain accounting standards, aiming for accurate reporting and compliance. However, recent developments by the Financial Accounting Standards Board (FASB) signal a shift toward fair value reporting for digital assets—meaning the traditional “impairment-only” model under U.S. GAAP is set to change.

Under GAAP (Legacy vs. New Practice)

Under the legacy model, crypto assets have been classified as indefinite-lived intangible assets. Regular impairment testing was required—if the market value dropped below the carrying value, an impairment loss was recorded based on the lowest observable market price. Any subsequent recovery in market value could not be recognized until the asset was sold. In October 2022, however, FASB tentatively decided to require measuring in-scope digital assets at fair value, with both upward and downward valuation changes recognized in earnings. Though not yet fully finalized, this move marks a departure from the impairment-only model and brings GAAP closer to real-time market value reporting, improving transparency for investors. The final Accounting Standards Update (ASU) is expected to clarify the timeline for mandatory adoption once it is formally issued.

Under IFRS

Under the default cost model, which aligns with GAAP’s legacy approach, companies must test for impairment if there are indicators of a value decline; upward revaluations are not permitted unless the asset is sold. If an active market exists, however, companies can opt for the revaluation model, allowing both upward and downward revaluations to reflect fair market value. In this case, ongoing revaluations are required, and any changes in value are recognized in other comprehensive income (OCI) or earnings (depending on the asset classification).

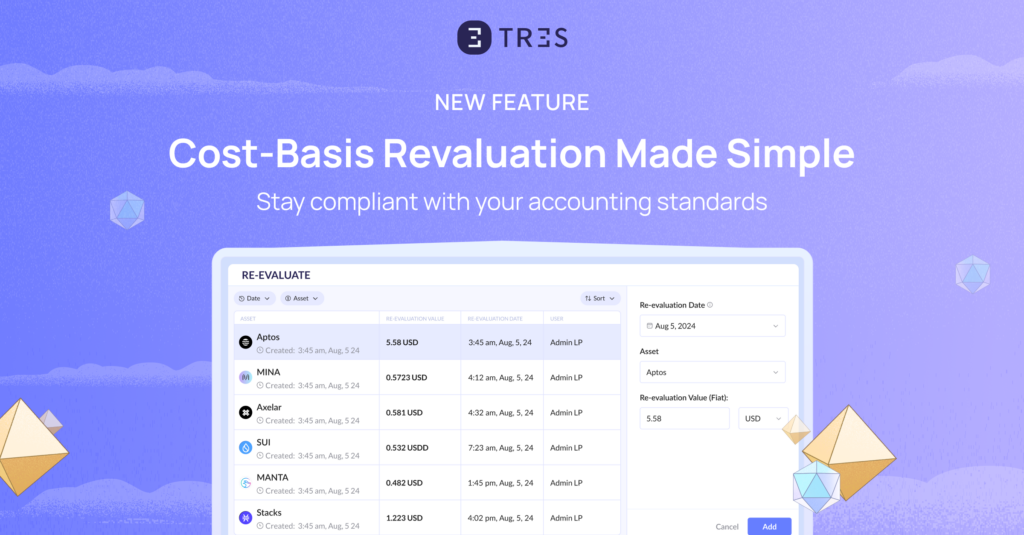

How Does Revaluation Work at TRES?

We have designed our revaluation feature with flexibility in mind, ensuring it adapts seamlessly to any accounting standard.

- Our solution empowers clients to select a specific asset at a chosen point in time, enabling precise pricing for cost-basis adjustments.

- Once the asset and time are selected, the asset’s repricing is processed.

- The updated valuation is then applied to future gains and losses upon the sale of that asset, providing clarity, compliance, and ease for financial reporting.

This streamlined process ensures that your accounting remains accurate and compliant with regulatory standards, no matter how complex your asset portfolio.

Simplified Compliance, Streamlined Audits

At TRES, we empower businesses worldwide to maintain compliance with ease. With unparalleled data accuracy and a streamlined FinOps experience, we make every step of the process effortless. Join TRES today and experience compliance made simple.

Interested in TRES?