At TRES, we are committed to empowering businesses with reliable blockchain data and providing the highest possible flexibility for your financial operations. That’s why we’re excited to announce the launch of HiFo (Highest in First Out) as the latest addition to our cost-basis options, further expanding the flexibility of TRES FinOS. With this feature, users can now take full control of their tax strategy, particularly in the fast-evolving crypto market, where efficiency and agility are critical.

Flexible Cost-Basis Calculation for Better Tax Management

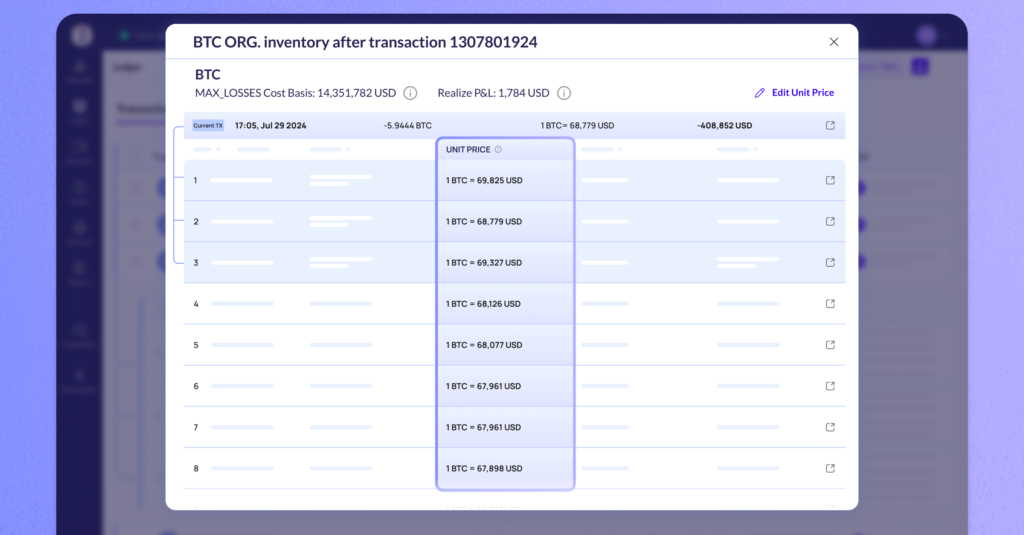

In addition to FiFo and Weighted Average, TRES FinOS now supports HiFo, giving users the ability to select the cost-basis method that best suits their needs. The introduction of HiFo allows you to optimize your tax strategy by maximizing losses, which can significantly reduce tax liability. By selling your most expensive assets first, you can generate higher capital losses, which can then be used to offset gains elsewhere in your portfolio.

Seamless Setup for HiFo

We’ve made the implementation of HiFo incredibly simple. Users can activate this feature directly from the Settings page on the TRES platform. Once there, simply select HiFo as your preferred cost-basis method. You also have the option to choose whether the calculation applies per asset or per wallet, giving you even more granular control over your financial reporting.

With just a few clicks, TRES FinOS will automatically recalculate your cost basis by ordering your asset purchases from highest to lowest, allowing you to immediately benefit from the HiFo methodology.

Experience the Full Power of TRES FinOS

The launch of HiFo further enhances the flexibility of TRES’s accounting offerings. Our platform’s commitment to flexibility and precision means that you can confidently navigate the complexities of the crypto space, knowing that your data is always optimized for your specific needs.

Activate HiFo today and take control of your tax strategy with TRES FinOS.

Interested in TRES?